Just the FAQs

January 27, 2023

Top 10 Bottlenecks

February 9, 2023Where It Comes From, Where It Goes.

Infrastructure: Working on It

Every wonder what happens to your tax payments?

From sales tax on groceries to tax at the gas pump, and from tax on your new car to paying Uncle Sam by every April 15th, we seem to perpetually funnel money into the great unknown…er, taxes.

Naturally, our focus is on transportation, and here we see a lot of funding for it from our taxes. Our taxes go to local, state, and federal accounts, which, in turn, allocate that money for spending projects.

Among other things this often involves a house-that-Jack-built scenario. For example, we might not immediately think that funding for public transportation ⏤ commuter railroads, public buses, etc. ⏤ would be favorable to the commercial trucking industry.

Yet, take a step back and see the effect of more people taking public transportation to work. That helps to unclog our roads and highways. And this helps to reduce traffic jams that delay the nation’s commercial transportation deliveries.

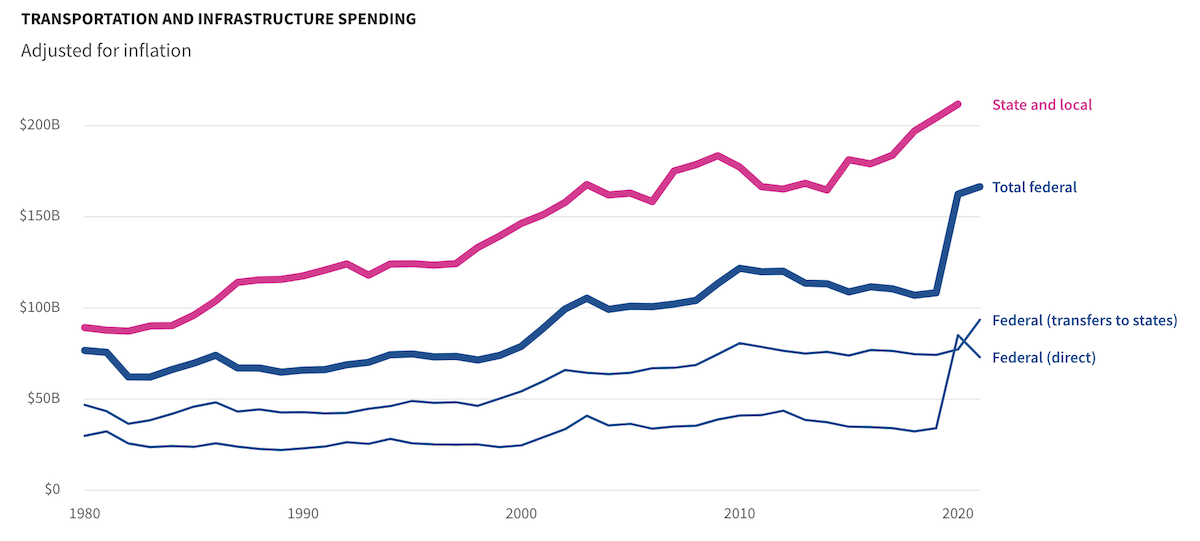

As for the numbers, USA Facts tells us:

- In 2021, about 41% of federal transportation and infrastructure spending was on highway transportation and 32% was on air travel. The remainder was for rail and mass transit (19%) and water (8%).

- Most transportation and infrastructure spending comes directly from state and local governments, which spent $191.1 billion on projects in 2019, excluding federal transfers.

- The federal government spent $71.3 billion directly on infrastructure in 2021 and transferred an additional $81.7 billion to states.

Source: USA Facts / US Office of Management and Budget

From the American Road & Transportation Builders Association, this is how our local and state governments are able to provide funding:

- State Motor Fuel Excise Taxes

- Variable-Rate State Gas Taxes

- Alternative Fuel & Electric Vehicle Taxes & Fees

- Bonding

- Tolling

- Road Usage Charges & Cordon Pricing

- Overview of P3 & Financing Approaches

- Federal Funding

The federal motor fuel excise tax is our main funding source for U.S. federal highway infrastructure investment (from eight cents/gallon in Alaska to more than 30 cents/gallon in a handful of states.)

Another source? Traffic violation fines. Now, we’re not encouraging you to get a parking ticket. If and when you do, though, know that your payment is going to a good cause.